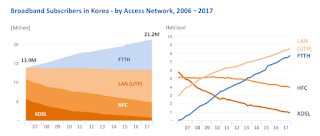

1. South Korea

I found a website (Netmania.com) which reports Korean broadband statistics. Korea's population is around 51M in 2019. Korean count of households in 2005 was about 16M, so with population growth is likely now about 18M. |

| Netmanias.com |

Korea is looking at next generation broadband, aiming for 50% adoption of 10Gbps by 2022, presumably over the FTTP, which would rise to 50% of total households (from 8M to 9M). Netmanias reports 24% of KT Subscribers have gigabit internet in Q3 2016 (around 2M services; after 7 quarters of availability).

Interestingly, Netmanias report, Korea's telcos (SK Telecom, KT and LG U+) make only a smallish proportion of their total 2017 $52B revenue from fixed line broadband; around $12B of total. Most revenue comes from mobile ($21B) and handsets ($6B).

Current pricing for gigabit services in Korea (with unlimited data) is around $60 per month on a one year contract (SK Broadband) plus setup costs ($25) and monthly equipment rental ($5/mth). Speed is limited to 100Mbps when exceeding a 100Gb data limit (per day).

2. China

2.1 Overall

China, a country of 1.45B people and 450M households has recently upgraded its broadband. By 2017, 84% of broadband users had a FTTH connection; some 290M households, according to the most recent CNNIC report (end 2017, p.27-28; see graph below- note: 10k scale). The graph below shows that China fibre broadband rose from 20M users (2012) to 290M users (2017), including some 62M connections added in 2017 alone. (Update: June 2019 report released (pdf); noting 395M Fibre connections (p.11) and 77% of broadband subscribers at 100Mbps or over; p.11). |

| CNNIC - China Internet Network Information Center (2017) |

2.2 China Strategy

China pushed their broadband forward in a 2013 China Broadband Strategy and Implementation plan. Further the General Office of the State Council, issued "Guiding Opinions on Accelerating the Construction of High-Speed Broadband Networks, Increasing the Network Speed and Reducing Access Charges" per CNNIC report (p.56).The broadband targets in China were:| Year | Speed(Mbps) | %Urban | Comment |

|---|---|---|---|

| 2015 | 20 | 50% | |

| 2020 | 50 | 70% | plus 50% at 100Mbps, some gigabit |

2.3 China Mobile - Qtrly stock market reports

More recent information comes from China Mobile who reports quarterly to investors. China Mobile at the time of the CNNIC report, reported 109M fixed broadband users (up from 74M in 2016). In 2017, around 70% of their wired broadband subscribers, China Mobile reports, subscribe at over 50Mbps speeds. By Q1 2019, China Mobile report 167M wired broadband customers, up 10M for the quarter (plus a breathtaking 963M mobile subscribers (723M on 4G), using 6Gb of data monthly, up 162%). Thus China Mobile would have around 30-40% of the fixed broadband market and the China households (by 2019) are fully connected to broadband, likely at more than 85% on FTTP. Fixed Broadband ARPU was RMB 31 (about $6) per month.What does this rapid and extensive rollout in China mean for the value of Australia's NBN? More thoughts to come...

Update: China Mobile reports (p.17) in Q2 2019, 175M wired broadband customers, with 80% over 100Mbps on "1000Mbps all-optical fibre broadband network", up from 135M (2018). ARPU is 35 RMB (less than $10AUD/mth).

3. Analysis

Sth Korea has followed a more NBN like approach with multiple technologies. HFC still plays a part (about 25% of households), but the next generation target is only for 50% of households - similar to the NBN level of gigabit-ready households. China in contrast has (at least two years ago) around 85% of urban subscribers on FTTH. Last time we noted that the US has around 30% of subscribers on over 100Mbps plans (around 30M connections). China, has the potential at least to have 85% (about 290M plus premises) on over 100Mbps plans. NZ already has 10% of subscribers on gigabit plans. Sth Korea's KT has about 25% of its subscribers on gigabit services. While Australia, until affordable gigabit services arrive has effectively 0% of NBN subscribers on gigabit services.Gigabit Users and Potential Users (or over 100Mbps**) - selected countries

| Country | Gigabit (100Mbps) Users | Gigabit % | Gigabit access potential %(M users) |

|---|---|---|---|

| AU | nil^ | 0%^ | 50% (5M) |

| NZ | 0.1M^ | 10%^ | 90% (1.8M)^ |

| Sweden | (2-3M) | ?? | 98% by 2025 (3M) |

| Sth Korea | est 4M (per above^^) | 25%^^ | 50% by 2022 (8M)^^ |

| US | 3M [1] (30M)^ | about 30%** | ?? at least 66M HFC |

| China (p.4) | 19M (Source [1]) | 4% | over 85% potential (>290M) |

So Australia with 50% of potential gigabit users is in line with South Korea as a leading broadband nation. But moving from potential to actual users, depends on the value of the NBN offer. A competitive price would likely be similar to NZ, at around $100 per month, but that price so far has only attracted 10% of users to gigabit.

One commentator suggests in most countries gigabit will rise to 30% by 2023, and in some countries (France, Switzerland and South Korea, China) to 40-50% of households.

4. Unanswered questions:

- how many gigabit users in China? What will gigabit cost? (300 Yuan($60)/mth; China.org.cn)

- what speed do users in China connect at? (Speedtest #28; avg 85Mbps)

- when will AU NBN introduce gigabit services? At what price? Current TPG Business service $880/mth on 36mth contract (ie $32k). See more at NBN Business analysis. Update (Sept.19): NBN proposes household gigabit (1000/50) service at $80/mth wholesale (Whirlpool), likely to retail around $130/mth.